Looking at Candy Crush by the Numbers

With only two days left until King Digital Entertainment becomes the latest gaming company to be publicly traded on the New York Stock Exchange, investors are less certain than ever about the company’s future. As of Wednesday, the creators of Candy Crush will be selling stakes in their rapidly-growing company, and many people are anxious to get on board, even for $24 USD per share. King’s owners stand to control a company worth over $7 billion less than 48 hours from now–but will their IPO (Initial Public Offering) really go off without a hitch?

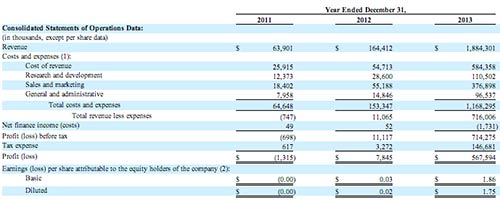

Ever since King first announced they were applying to be publicly traded, financial analysts have been of two minds about whether this is the right path for the company that brought us Papa Pear, Farm Heroes, Pet Rescue, and of course the unavoidable Candy Crush Saga. King certainly thinks this is the best choice–in their prospectus last month, they pointed out that in 2013, their net income was nearly $2 billion. This has mostly been due to the success of Candy Crush, which has crested 53 million daily users on Facebook alone. (The total number of daily users across platforms is approximately 93 million worldwide.)

Most of that money comes from a dedicated core set of players who will gladly shell out for extra lives and boosters in Candy Crush. But many analysts have cautioned that, despite its meteoric rise, King won’t last long in the video game industry unless it can prove it has cracked the code to making a long series of popular games, rather than coasting on just one. King itself admitted in its prospectus that should its audience drift to other casual games, or stop making in-app purchases, their revenue stream will dry up quickly.

But, as CNNMoney notes, the last few years have been great for IPOs. Last year saw the most IPOs since 2000, and most of this year’s new stocks have increased in value by up to 35%. But this doesn’t necessarily mean that King will meet with the same fortune. The same article notes that nearly 75% of recently public companies are not profitable, echoing many analyst’s fears that King will go the way of Zynga, the game company whose stock prices plummeted from $10 to $2 nearly overnight.

Will you be among the first to invest in King this Wednesday, or are you withholding judgment? Tell us your opinion in the comments!