Candy Crush Giant Looks for $7+ Billion Valuation

It’s starting to get real out there. King Digital Entertainment filed its paperwork with the United States Securities and Exchange Commission (SEC) to become a publicly-traded company on the New York Stock Exchange (NYSE).

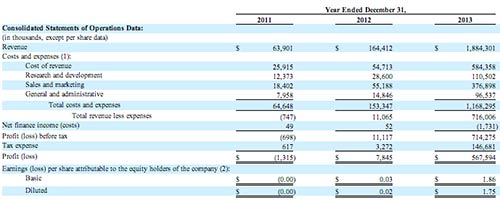

We knew this was coming, but for many of us, this was our first chance to get a substantial glimpse into the state of King’s finances. Now that we have the full prospectus to consider, the true extent of how King has dominated the casual gaming market is starting to become more clear than ever before, along with their rewards for having done so. For those who are still skeptical as to whether the Irish company is truly as profitable as they claim, check out the table below and meet us after the jump.

Remember, this table is in thousands of dollars, so add three zeroes after every number to get the real picture. So while King was in the red back in 2011, before Candy Crush really hit the big time, it’s now more than made up for its losses. King pulled in profits of almost $8 million in 2012, and reported nearly $2 billion in net income for 2013. These are some serious numbers for any company, let alone one that can trace back the vast majority of its wealth to a simple free-to-play match-3 game.

Based on these numbers, King says it plans to price its shares between $21 and $24 apiece. This could generate over $530 million when the shares go on sale, and more if King decides to make more of its own shares available for purchase. It’s an aggressive plan, and one that assumes that King’s properties (present and future) will continue to grow in value as quickly as Candy Crush has in the past few years. But Candy Crush is the only game that’s pulling in the money in carts for King–its closest relative, Farm Heroes Saga, has about a fifth of Candy Crush’s daily users and shows no signs of taking off in the same meteoric fashion. Even more nerve-wracking, King’s starting share price will be twice that of the much-ballyhooed Zynga IPO, which opened at $10 only to plummet soon after.

Only time can tell for sure, but do you think King’s IPO will be a hit or a flop? Read the full SEC prospectus here, and leave us a note in the comments with your thoughts!