Connecting the Dots Between Gaming Giants

It’s the eve of King Digital Entertainment’s long-awaited initial public offering (IPO), when the legendary creators of Candy Crush Saga will make their company available for purchase on the New York Stock Exchange. Though they’ll have to answer to their shareholders, King’s owners stand to make a staggering amount of money in the deal. And as we’ve discussed in the past few weeks, there are pros and cons to this move for King. But this monumental event doesn’t exist in a vacuum–it’s very similar to what happened to Zynga several years ago.

For those of you who don’t remember Zynga, we’ll back up and explain. Zynga is the company behind one of the first “social games” as we’ve come to know them–FarmVille. Founded in 2007, Zynga secured millions of dollars in venture capital, which it used to develop several games for Facebook. In early 2009, it became the biggest Facebook app developer before debuting FarmVille later in the year. FarmVille catapulted the company to Internet fame, and Zynga filed for a billion-dollar IPO in 2011. Since then, however, their revenue and stock price has plummeted, trading at just $4.83 USD as of this writing.

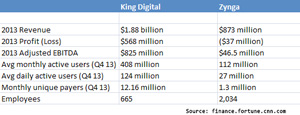

Writing for CNN Money, Dan Primack compiled a table comparing Zynga and King’s most recent financial data, and the results seem to be in King’s favor:

Clearly, King has the advantage over Zynga in many arenas. The most substantial of these in the long term is most likely the number of employees each company has; Zynga employs over two thousand people, while King employs less than seven hundred. When Zynga went public, it suffered a loss of over half a billion dollars in compensation plans for its employees, an expenditure which King will not need to worry about quite so much.

Still, there are more similarities here than differences in how both companies have quickly risen in the gaming industry on the back of a few immensely popular games. King derives the vast majority of its income from Candy Crush, even more than Zynga relied on FarmVille. It’s no wonder investors are skittish about King’s IPO tomorrow–but there’s only one way to find out for sure what will happen: wait! We’ll bring you all the news every day.